Advance Auto Parts Inc. (AAP)

The Zacks Retail and Wholesale sector has modestly underperformed relative to the S&P 500 more than the final calendar year, down roughly 15{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}.

A single business residing in the sector, Advance Automobile Sections AAP, has seen its earnings outlook change damaging above the past quite a few months, pushing the stock into a Zacks Rank #5 (Strong Offer).

Impression Resource: Zacks Financial commitment Investigate

Progress Car Parts largely sells replacement pieces (excluding tires), accessories, batteries, and upkeep merchandise for domestic and imported cars, vans, sport utility automobiles, and gentle and hefty-duty trucks.

Let us choose a deeper dive into how the firm designs up.

Share Effectiveness

Over the final yr, AAP shares have commonly lagged powering the S&P 500, down a lot more than 30{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}.

Image Supply: Zacks Expense Investigate

And more than the last 3 months, sellers have remained in command, with shares down 13{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} and once more lagging at the rear of the common current market.

Graphic Resource: Zacks Financial commitment Investigation

Quarterly Final results

Advance Car has struggled to obtain regularity within its quarterly benefits, slipping brief of the Zacks Consensus EPS Estimate in back-to-back again quarters. Prime-line benefits have also remaining some to be desired, with AAP lacking profits anticipations in 3 consecutive quarters.

Just in its latest launch, the enterprise fell small of earnings anticipations by around 15{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} and documented revenue marginally under estimates.

Impression Source: Zacks Expense Analysis

Expansion Outlook

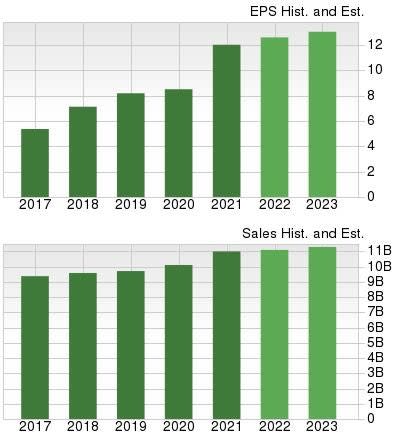

In spite of its earnings outlook coming below stress, AAP still carries a respectable growth profile, with earnings forecasted to climb 5{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} in its present fiscal 12 months (FY22) and a further more 5.4{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} in FY23.

The projected earnings development will come on top rated of forecasted Y/Y profits upticks of 1{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} in FY22 and 2.6{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} in FY23.

Image Resource: Zacks Financial commitment Investigation

Base Line

Inconsistent quarterly benefits and adverse earnings estimate revisions from analysts paint a tough photo for the firm in the around phrase.

Progress Auto Areas AAP is a Zacks Rank #5 (Strong Market), indicating that analysts have reduced their base-line outlook across the final quite a few months.

For individuals in search of potent stocks, a good idea would be to target on stocks carrying a Zacks Rank #1 (Robust Invest in) or a Zacks Rank #2 (Purchase) – these stocks sport a notably more robust earnings outlook paired with the potential to produce explosive gains in the in close proximity to time period.

Want the most recent suggestions from Zacks Financial investment Study? Today, you can obtain 7 Greatest Shares for the Following 30 Days. Click on to get this cost-free report

Advance Car Parts, Inc. (AAP) : No cost Inventory Investigation Report

To examine this article on Zacks.com click on in this article.