J.P. Morgan Sees 70{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} Upside for These 2 Auto Stocks

There is been a ton of communicate about the downward financial pressures that have pummeled the markets in 2022 – probably much too significantly these kinds of communicate. Sure, the S&P 500 is down nearly 21{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}, and the NASDAQ is down 35{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}, but investors can nevertheless find seem possibilities. J.P. Morgan analyst Ryan Brinkman has been sorting by the automotive marketplace shares, and he’s located a number of that are really worth a closer look.

So let’s do just that. We know that the automobile field has its very own particular headwinds, such as the ongoing microchip shortage and uncooked substance selling price inflation, and that these are pumping up costs. But the provide chain issues are easing, and are envisioned to relieve additional into 2023.

Brinkman, in some general notes on market, writes, “There are some glimmers of normalization, with rates last but not least easing fairly, even though ailments continue being much from normal…. 2023 has greater possible for a additional rapid improvement in the quantity setting and a more swift normalization in pricing, with the wildcard staying an financial downturn.” Placing some quantities on this prediction, Brinkman’s colleagues at JPM are modeling 2.5{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} to 5{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} selling price moderation in new cars, and 10{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} to 20{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} in employed automobiles, by the calendar 12 months 2023.

As for investor positioning, Brinkman is tapping two automobile-similar stocks for a single-calendar year gains perfectly in surplus of 60{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}. Let us just take a seem at these two picks, applying the latest data from TipRanks as effectively as the analyst’s comments, to get a really feel for their opportunity.

Kar Auction Companies, Inc. (KAR)

Very first up, KAR Auction, a chief in the world’s 2nd-hand auto auction sector. The business operates in both of those the on the internet and bodily worlds, connecting sellers and purchasers, and counts equally corporations and specific people in its client base. KAR features automobiles for a wide selection of makes use of, from commercial fleets to non-public travel to the next-hand vehicle sections marketplace. Pre-pandemic, in 2019, KAR sold 3.7 million motor vehicles and created $2.8 billion in auction earnings.

The mixture of, very first, COVID, and next, high inflation, has pushed down on KAR’s top line the organization observed $2.25 billion in overall revenues for 2021, and so considerably this calendar year the income totals are not matching that. In the previous quarter, 3Q22, the enterprise claimed $393 million at the major line. This was down 26{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} year-in excess of-12 months but a sequential improvement which the corporation attributed to an boost in gross profit for each car marketed, and to amplified costs, which have offset decrease volumes. KAR noticed a gross profit per automobile bought of $320, up 14{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} from the $280 described in the prior year’s Q3.

Also indicating a good outlook, KAR described a web earnings, with altered web income for 3Q22 coming it at 9 cents for every diluted share. This in contrast favorably to the 11-cent loss documented one year before.

In his protection of this stock for JPM, Ryan Brinkman details out a number of explanations why the firm has been capable to endure the present market difficulties – and why it is most likely to stand tall going forward. He writes, “KAR has a powerful situation in this industry: it is the second-biggest provider of entire motor vehicle auction services. The resulting confined competition and large barriers to entry result in powerful pricing and margins and sturdy totally free dollars movement given small performing money necessities. We expect sound earnings development around the up coming several years, driven by cyclical restoration in at present depressed commercial consignor volumes and the firm’s thrust into the digital Supplier-to-Supplier room alongside with envisioned ongoing charge containment and exploration of many adjacencies, like retail reconditioning.”

These remarks back up Brinkman’s Overweight (Buy) score, and his $22 price concentrate on implies a attain of 75{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} for the shares around the following 12 months. (To observe Brinkman’s keep track of file, simply click right here.)

Brinkman is not the only analyst who is bullish on the foreseeable future of KAR the stock has 4 modern testimonials, all favourable, for a unanimous Sturdy Invest in analyst consensus. The typical cost concentrate on is $22, matching Brinkman’s aim. (See KAR’s inventory forecast at TipRanks.)

Unique end-of-12 months offer: Accessibility TipRanks Quality resources for an all-time very low price! Simply click to study additional.

Camping World Holdings (CWH)

Up coming up is a specialized car stock, Camping Entire world Holdings. This firm promotions in leisure vehicles, offering a vary of towed and run RVs for sale new and utilized, as effectively as supporting gear, add-ons, and other similar products and solutions like boating and drinking water sporting activities vessels and their equipment. In limited, Tenting Globe Holdings places a earth of outdoor leisure less than 1 gross sales place.

Camping World’s sales and revenues are predictable, and adhere to a standard seasonal pattern with a peak in Q2 and a trough in Q4. With that in brain, the enterprise posted revenues of $1.9 billion for 3Q22, a 3{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} y/y drop but beating the Street’s forecast by $100 million. Used device product sales totaled 14,460, for a enterprise record, and employed auto profits was up additional than 1{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}, to $526 million.

The enterprise noted greater inventories for the two new and used autos, to $1.6 billion, in Q3, an maximize attributed to restocking new motor vehicles to regular ranges, as properly as strategic growth in the used automobile small business. The organization opened 8 supplemental dealership spots for the duration of the quarter.

On the base line, the firm noticed a steep fall-off. Altered diluted EPS fell from $1.98 in 3Q21 to $1.07 in the the latest quarterly report, a 45{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} y/y decrease.

Even though earnings are down, CWH has preserved its popular stock dividend. The enterprise past declared a payment of 62.5 cents for every share, for payment on December 29. At that fee, the dividend annualizes to $2.50 for each common share and yields a effective 11{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}, far more than plenty of to conquer the current rate of inflation and be certain a true charge of return.

JPM’s Ryan Brinkman highlights the causes why he thinks the stock is one to very own. He writes, “Camping World’s considerably greater scale presents it with quite a few added benefits relative to its more compact opponents, together with (1) gross margin-enhancing volume bargains (2) more favorable terms with financiers (3) the capability to provide shoppers a broader assortment by tapping into the stock available across its better amount of outlets and (4) an informational gain in terms of customer desire and pricing in the marketplace. The combination of the fragmented character of the current market and the sizeable rewards supplied by scale in our perspective presents ample prospect to generate worth by even further consolidating the marketplace, and Tenting Entire world has traditionally been really acquisitive.”

Placing some quantities to his stance, Brinkman premiums the inventory as Over weight (Buy) with a $37 price goal indicating probable for 72{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} share appreciation in the coming calendar year.

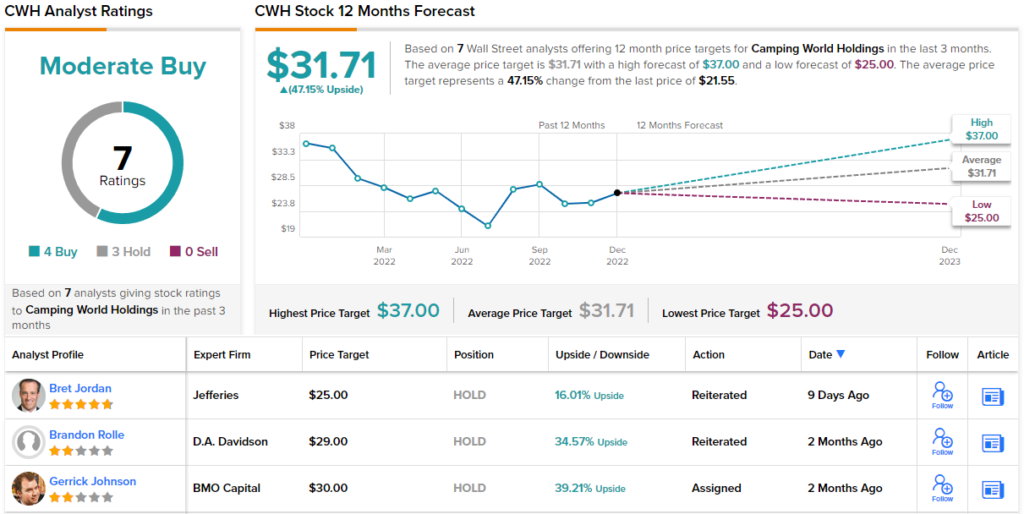

This stock retains a Moderate Get consensus rating from the analysts on Wall Road, with 7 current opinions breaking down to 4 Buys and 3 Retains. The stock is trading for $21.55 and has an normal rate concentrate on of $31.71, implying a just one-calendar year upside of 47{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}. (See Camping Planet Holdings’ inventory forecast at TipRanks.)

To discover great strategies for shares buying and selling at appealing valuations, check out TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ fairness insights.

Disclaimer: The views expressed in this posting are solely those of the highlighted analysts. The articles is supposed to be made use of for informational reasons only. It is quite vital to do your own analysis before building any expenditure.