Why Advance Auto Parts, Inc. (NYSE:AAP) Could Be Worth Watching

Advance Automobile Areas, Inc. (NYSE:AAP), is not the greatest company out there, but it obtained a lot of consideration from a significant rate motion on the NYSE over the past couple of months, expanding to US$157 at a single position, and dropping to the lows of US$111. Some share price tag movements can give buyers a much better prospect to enter into the inventory, and potentially obtain at a decreased selling price. A query to respond to is no matter whether Advance Car Parts’ present investing rate of US$119 reflective of the real value of the mid-cap? Or is it currently undervalued, offering us with the option to acquire? Let’s get a seem at Progress Automobile Parts’s outlook and value based mostly on the most modern monetary information to see if there are any catalysts for a value modify.

View our hottest examination for Advance Car Pieces

Is Advance Car Elements Even now Low-priced?

Excellent news for investors – Progress Automobile Areas is still buying and selling at a quite affordable selling price. My valuation model demonstrates that the intrinsic worth for the inventory is $173.51, but it is at the moment buying and selling at US$119 on the share industry, indicating that there is however an chance to get now. On the other hand, presented that Advance Auto Parts’s share is reasonably risky (i.e. its selling price movements are magnified relative to the relaxation of the industry) this could signify the value can sink decreased, giving us yet another opportunity to get in the foreseeable future. This is based mostly on its significant beta, which is a good indicator for share rate volatility.

What form of progress will Progress Vehicle Parts make?

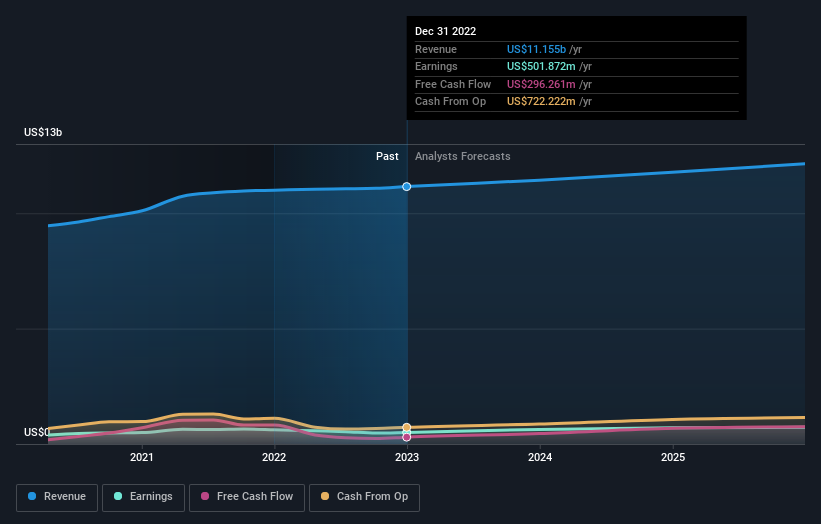

Investors searching for advancement in their portfolio could want to take into account the potential customers of a corporation in advance of obtaining its shares. Buying a excellent enterprise with a strong outlook at a inexpensive selling price is constantly a good financial investment, so let’s also consider a glimpse at the firm’s long run expectations. Advance Auto Parts’ earnings about the future couple a long time are predicted to raise by 44{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5}, indicating a very optimistic foreseeable future ahead. This really should direct to a lot more sturdy dollars flows, feeding into a greater share price.

What This Usually means For You

Are you a shareholder? Given that AAP is at present undervalued, it may well be a fantastic time to accumulate more of your holdings in the inventory. With a positive outlook on the horizon, it appears like this growth has not however been totally factored into the share value. However, there are also other factors these as economical wellbeing to think about, which could reveal the current undervaluation.

Are you a likely investor? If you’ve been holding an eye on AAP for a even though, now might be the time to make a leap. Its prosperous foreseeable future outlook isn’t absolutely mirrored in the present-day share cost nonetheless, which indicates it’s not way too late to purchase AAP. But prior to you make any investment conclusions, contemplate other aspects these types of as the power of its equilibrium sheet, in order to make a effectively-informed financial commitment conclusion.

So whilst earnings top quality is critical, it is really equally essential to contemplate the dangers struggling with Advance Automobile Pieces at this stage in time. Situation in position: We have noticed 2 warning indicators for Progress Car Sections you must be informed of.

If you are no extended fascinated in Progress Auto Pieces, you can use our totally free system to see our record of over 50 other stocks with a large expansion prospective.

What are the pitfalls and opportunities for Progress Car Elements?

Advance Vehicle Areas, Inc. offers automotive replacement elements, add-ons, batteries, and maintenance objects for domestic and imported autos, vans, activity utility motor vehicles, and mild and hefty obligation vehicles.

See Comprehensive Investigation

Benefits

-

Trading at 30{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} below our estimate of its truthful value

-

Earnings are forecast to increase 10.39{49e09b23eae7466ccc7574c19ebb3019301c9a11d2999feff81a3526451546a5} per yr

Risks

Check out all Hazards and Rewards

Have feed-back on this posting? Concerned about the material? Get in contact with us straight. Alternatively, email editorial-team (at) simplywallst.com.

This report by Simply Wall St is general in mother nature. We supply commentary based mostly on historical data and analyst forecasts only utilizing an unbiased methodology and our content articles are not supposed to be economical advice. It does not constitute a advice to buy or sell any inventory, and does not just take account of your aims, or your financial circumstance. We aim to deliver you extensive-expression focused analysis pushed by elementary data. Note that our investigation might not variable in the most recent value-delicate organization bulletins or qualitative content. Merely Wall St has no posture in any shares described.